LOGISTICS RESEARCH

By Joakim Hans Kembro and Andreas Norrman

The warehouse is increasingly viewed as a strategic component, particularly in retail. This trend is driven by the evolving retail landscape — including e-commerce and omnichannel — which has raised customer expectations for broader product assortments and faster, more flexible deliveries. Companies, especially retailers, are investing heavily in automated warehouse systems (AWS).

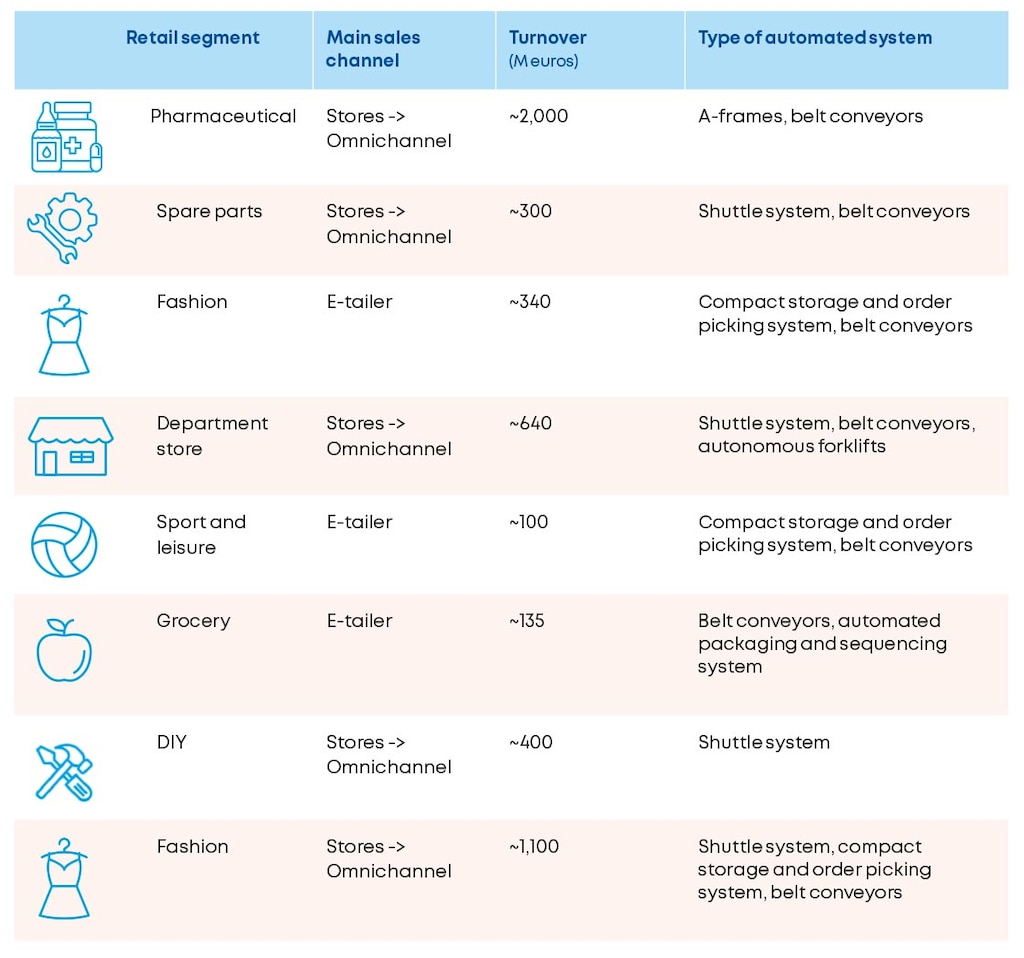

The authors conducted a case study involving eight retailers that had recently made significant AWS investments. All are based in or operate from Sweden but have been increasing their international presence. The retailers were purposefully selected from an original sample of 300 invited companies based on the following criteria:

- Completed or in the process of implementing a large AWS.

- Different degrees and types of automation technology.

- Several sales channels (omnichannel vs. pure e-tailers).

- Mix of segments and products.

All eight case study retailers perceived themselves to be early compared to competitors.

Overview of the eight case companies. Source: Authors’ own creation

As a first step, the authors collected data through exploratory surveys and guided visits in the eight retailers’ automated warehouses. The visits also included interviews with one or more key personnel, including a supply chain director and logistics, warehouse, production and sustainability managers.

Investments with long-term impact

The most obvious evidence of the warehouse’s increased strategic role is the retailers’ willingness to make large AWS investments with long-term impact. External key investment drivers include Industry 4.0 and the rapid development of material-handling technology, proven business cases with global online giants leading the way, increased competition and plummeting profit margins, leading retailers to focus on cutting operational costs.

The most popular technologies among retailers include compact storage solutions and shuttle systems

The most popular technologies among Swedish retailers include compact storage solutions, shuttle systems, location-bound sorting, packaging, weighing, sizing and palletising. In recent years, the range of AWS has expanded to feature autonomous forklifts, vehicle-based storage and retrieval, robotic piece-picking and autonomous mobile robots (AMRs), among other options.

Technology adoption and strategic intent

Strategic intent can be conceptualised as competitive priorities of the company, i.e. the strategic goals and objectives that should be achieved. Considering that highly automated warehouses increasingly resemble dedicated production lines, it is reasonable to hypothesise that AWS investments may have implications for future strategic manoeuvring.

Highly automated warehouses increasingly resemble dedicated production lines

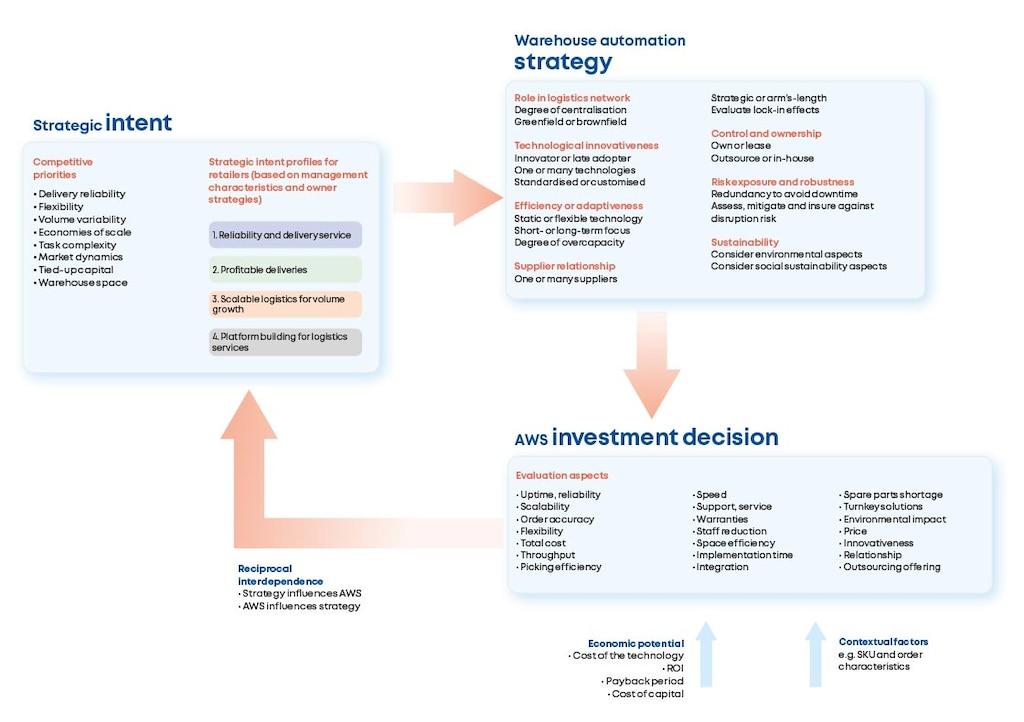

From a business perspective, strategy concerns a long-term perspective on company direction, objectives and configuration decisions. The automation strategy — together with economic potential and well-known contextual factors (e.g. SKU and order characteristics) — lays the foundation for AWS investment. Kembro and Norrman’s hypothesis, supported by the manufacturing literature, was that there is a reciprocal relationship between strategic intent and AWS investment decisions.

Competitive priorities

The researchers surveyed the case companies’ current and future competitive priorities. For warehousing, these revolve around cost, delivery lead time, reliability, flexibility, volume variability, economies of scale, market dynamics, task complexity, tied-up capital and environmental aspects.

The case companies reported environmental aspects as the strategically most important priority in the future (6.6). While speed and lead time (6.5) and economies of scale (6.5) were also highly rated, market and demand dynamics (5.9) and growth and scalability (5.9) were considered important, though relatively less so.

Different DNA, different choice

During the analysis process, Kembro and Norrman noted some fundamental differences in the organisations’ perspectives of and justifications for their AWS investment decisions. The authors’ research suggested four retail clusters with different DNAs, i.e., diverse combinations of management team origin (industry background), ownership structure, and focus on economic value creation. Their profiles help explain why the case companies invested in a certain degree and type of AWS.

- Reliability and delivery service. The first profile, a retailer with long-term owners, emphasises regulatory compliance, safety, and delivery service to customers. This company prefers proven technologies that minimise the risk of downtime.

- Profitable deliveries. With a clear retail DNA, these organisations have a long trading tradition. Ownership is concentrated in one or a few families, whose members are actively involved in operational management. Their strategic focus is on return on investment (ROI).

- Scalable logistics for volume growth. These retailers’ ownership structures are more short-term, so value can even be generated from the sale of the business. Some organisations prioritise growth over profitability.

- Platform building for logistics services. This profile seeks to increase shareholder value not only through its own operations but also through other retailers’ transactions.

Kembro and Norrman also surveyed the case companies’ perceptions of 21 factors for assessing AWS. The highest-ranked evaluation aspects included reliability (6.9), order accuracy (6.9), speed (6.9), throughput (6.8), picking efficiency (6.8), and scalability (6.6). Ultimately, AWS decision-making must be based on the organisations’ priorities and needs.

A reciprocal relationship

Finally, the authors empirically investigated the hypothesis of a reciprocal relationship between strategic intent and AWS investment decisions. All respondents confirmed that changes in the warehouse influence the logistics network and vice versa. They also affirmed that a warehouse automation strategy should be part of the overall logistics and supply chain strategy.

As illustrated in the following graph, strategic intent is driven by competitive priorities. It is also influenced by the management team’s industry background and the owners’ focus on economic value creation. The relationship between company strategy and AWS must be understood as reciprocal. In other words, strategy influences automation investment decisions, but the implemented AWS also shapes strategy.

Warehouse automation strategy framework. Source: Authors’ own creation

Implications for managers

Kembro and Norrman’s study offers a framework for formulating a warehouse automation strategy. Managers can use it, for example, to analyze their companies’ competitive priorities and plan projects. Additionally, the four strategic intent profiles and the discussion regarding owners’ and management teams’ characteristics (DNA) will help warehouse managers better understand the interdependence between strategic maneuvering and AWS.

Previously considered a “necessary evil,” warehouses are now regarded as “technology-enriched fulfillment factories with strategic relevance.” If the modern retail warehouse is becoming a more offensive piece of the strategic puzzle, this must influence the AWS strategy as well as the choice, design, and implementation of upgraded capabilities. In turn, the implemented automation solution must also be aligned with the organisation’s strategic intent.

AUTHORS OF THE RESEARCH:

- Joakim Hans Kembro. Department of Industrial and Mechanical Sciences, Division of Engineering Logistics, Lund University (Sweden).

- Andreas Norrman. Department of Industrial and Mechanical Sciences, Division of Engineering Logistics, Lund University (Sweden).

Original publication:

Kembro, J. H., Norrman, A. A strategic perspective on automated warehouse systems in retail: Insights from a multiple case study. International Journal of Physical Distribution & Logistics Management, Vol 55. No. 11. Emerald Publishing Limited (2025). To explore the study’s content and results in detail, the full article can be read and downloaded for free here.

© 2025 Joakim Hans Kembro and Andreas Norrman. Published under CC BY 4.0 licence.